The Floor Beneath the Dial: Inside Q2’s Quiet Comeback for Collectible Watches

Patek Philippe 1518. Courtesy of The Robb Report

Auction highs, tariff pressure, and the return of long-view buying mark the most stable quarter since 2021 — as Rolex, Patek, Cartier and Omega reassert their authority.

Just a few quarters ago, you could hear the hissing of air leaving the luxury watch market. From grey dealers in Dubai to collectors on Madison Avenue, there was a collective grimace each time a steel Rolex Daytona came down another thousand on Chrono24. But Q2 2025 tells a different story—one not of euphoric recovery, but of cautious stability.

In the last three months, global pre-owned watch prices posted their smallest decline since early 2022—down just –0.3%, according to data from Morgan Stanley and WatchCharts. If that sounds like a technicality, you haven’t been watching the auctions.

The Auction Rooms Speak

In early June, Phillips New York hosted a “white glove” sale, moving all 143 lots for a total of $25 million. Among them: a Patek Philippe 1518 at $1.45 million, Cartier Tanks that sailed past estimates, and a world record for a Bulgari Octo Finissimo. Just days later, Sotheby’s hammered a rare pink gold Patek Philippe Ref. 2499 for $4.3 million, while Geneva’s spring season brought in $56.3 million across four houses.

These aren’t just trophy pieces going to vaults in Singapore. They’re signals. After two years of softening, the high end of the secondary market is flashing green—at least for the right names.

Blue Chips, Not Moonshots

The shift isn’t across the board. The real winners—Rolex, Patek Philippe, Cartier, Omega—are the brands that have always played the long game. Rolex prices ticked up ~0.3% in Q1 and held through Q2, driven by no-date Submariners, vintage Daytonas, and the Datejust, which has quietly appreciated over +639% since 2010. Patek’s sportier references, like the Aquanaut, remain resilient. And then there’s Cartier, whose Tank and Santos models are finally getting priced like the design icons they are: +0.9% across the board last quarter.

The frothier independents and hyped microbrands? Still correcting. The speculative rush of 2021 isn’t coming back. What we’re seeing now is a return to fundamentals—condition, provenance, dial configuration. In a word: sobriety.

Patek Philippe Reference 2499 'Second Series' from Sotheby's 'Important Watches' June 2025

An important pink gold perpetual calendar chronograph wristwatch with moon phases, 1957

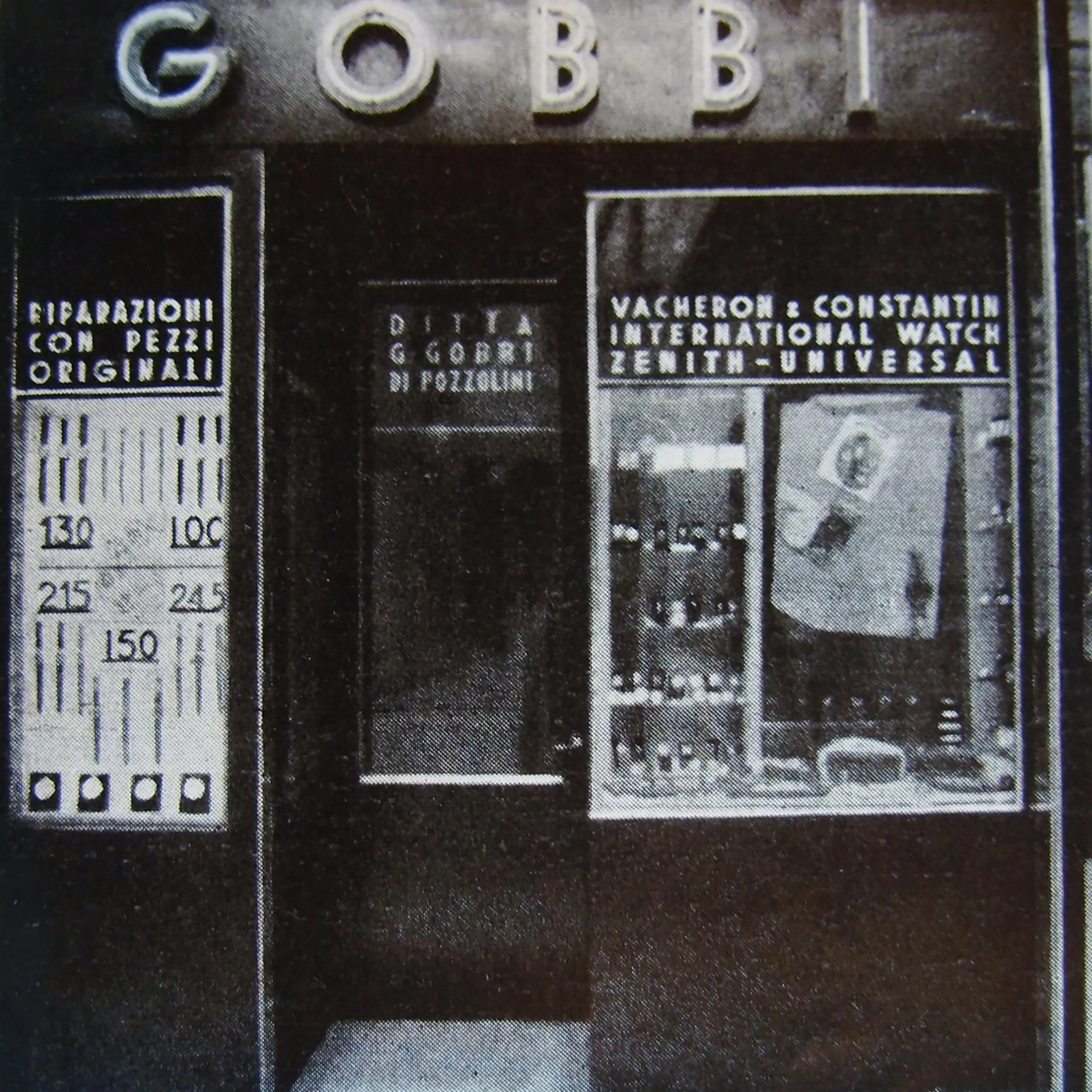

Retailed by Gobbi Milano

The Retail Squeeze

One reason for the shift: buying new has gotten harder—and pricier. A fresh round of U.S. import tariffs on Swiss watches, now hovering around 31%, has pushed retail prices north of tolerable. Add in the strong Swiss franc, and suddenly a boutique-bought Speedmaster feels like a finance thesis.

As a result, the secondary market has become a practical alternative. Not a bargain bin, not a pump-and-dump playground—just a place to find what the authorized dealers no longer have, at prices that make relative sense.

The New Asset Class (Again)

Talk of watches as investments is back in circulation—quieter, more mature. A recent Swiss study pegged the volatility of luxury watches at 3.9%—less than bonds or real estate. They may not rival tech stocks, but they don’t leak capital either. And unlike stocks, they tick.

This isn’t lost on younger collectors. One Los Angeles‑based buyer, who recently traded an NFT portfolio for a 1980s Datejust, put it plainly: “I don’t trust digital assets anymore. At least I can wear this to dinner.”

A Market with Memory

There’s something refreshing about the moment we’re in: a market that’s neither booming nor busted. What the auction houses are showing—and what secondary platforms like WatchBox, Chrono24, and Hodinkee’s pre-owned arm are confirming—is that people are buying again. Not in flurries, but with intent.

Vintage Daytonas under a million are clearing. Early Journes are being chased hard. Even the middle of the market—Speedmasters, neo‑vintage IWCs, two-tone Datejusts—is seeing meaningful volume.

This isn’t a return to irrational exuberance. It’s something more durable: a re-centering. Watches, it turns out, were never just about flex or investment. At their best, they’re about narrative—who wore it, where it went, how it ticks.

And if Q2 is any indication, the market has remembered that too.

Patek Philippe Aquanaut (Reference 5968A-001). Sold for $158,400 at Sotheby's 2022

The 1999 Cosmograph Daytona, Ref.16516, in platinum with a diamond-set mother-of-pearl dial had an estimate of $1.6 million.

Sidebar: 5 Watches That Defined the Q2 Recovery

From auction block headliners to quiet market movers, these five timepieces exemplify the momentum shift in the pre-owned space.

1. Patek Philippe Ref. 1518 (Pink Gold)

Auction: Phillips New York | Hammer Price: $1.45M

A perpetual calendar chronograph from the 1940s, and a perennial bellwether. When the 1518 performs, it signals top-end confidence is back. This result helped kick off Phillips’ $25M white-glove weekend.

2. Rolex Datejust 1601 (Neo-Vintage, Linen Dial)

Market Sale Range: $4,000–$7,200 (depending on condition)

While not an auction darling, the Datejust's steady climb—especially in neo-vintage configurations—shows that collector attention is shifting from hype pieces to versatile, daily-wearable icons.

3. Cartier Tank Louis (Manual Wind, 1970s–80s)

Auction & Private Sales: Multiple; Phillips saw record Cartier results

Long considered undervalued, the Tank’s resurgence has crossed over from fashion circles to serious collectors. Slim, gold, and now—finally—respected in the secondary space.

4. F.P. Journe Sympathique No. 1 (Clock + Wristwatch Set)

Auction: Geneva, Christie’s | Hammer Price: $6.55M

A mechanical marvel and a reminder that true independents—especially Journe—now operate in their own gravity field. The top-selling watch of the Geneva spring season.

5. Omega Speedmaster Professional “Moonwatch” (Early Tritium Dials)

Market Sale Range: $5,800–$9,500

Speedys have gone from collector standby to value-investment gold. Tritium-dial references from the ’80s and early ’90s are finally getting their due, often snapped up before they even hit the public listings.

“These aren't speculative buys. They're corrections—watches returning to where they should have been all along.”

Rolex Datejust 1601 Grey Linen